How to hire 1099 employee

How to Hire a 1099 Employee

The first thing you need to know about how to hire a 1099 employee is that, technically, there’s no such thing as a “1099 employee,” although it is a commonly used term.

It’s often used to describe an independent contractor who is engaged directly by an employer to either provide a service or work on a project. Employers who contract work with this category of consultants or gig workers are required to furnish them with an IRS 1099 form. In contrast, “W2 employees” are permanent workers hired on an ongoing basis who require W2 forms.

Referring to gig workers as “1099 employees” in the workplace isn’t accurate and could backfire. If your relationship with your 1099 contractors resembles the relationship you have with your permanent employees, you may be in violation of state and federal employment law. You may also find yourself the subject of an IRS audit.

The following guidelines should help you find the best contractors available.

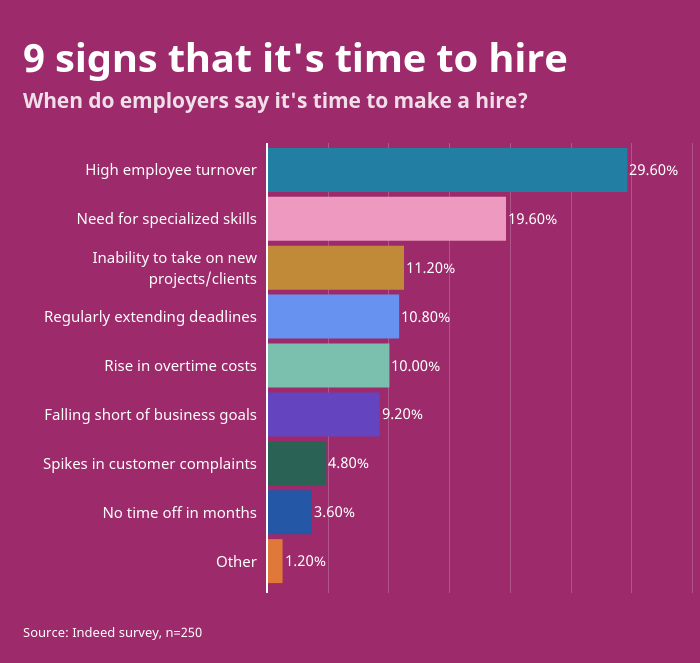

Using contractors rather than employees can be a useful solution for a small business that is growing just fast enough to overwhelm its owners, keeping them at work well past 40 hours a week, but not quite fast enough to support hiring full-time permanent help.

Let’s say you’re a chef and, unless you’re estimating ingredient measurements, numbers aren’t your strong suit. A self-employed bookkeeper or accountant could be the magic ingredient you need. Or, maybe your bakery’s online orders aren’t where you’d like them to be and it’s time to hire a professional web site designer. You get the idea. If any of these scenarios sound familiar, it may be time to learn how to hire a ‘1099 employee’, without running afoul of the IRS or federal or state labor law.

Hiring these specialists on a contract basis can buy you and your full-time employees time to focus on core business tasks, without the added time and expense that comes with hiring permanent staff.

Using a contract worker allows you to pay for work only when it’s needed and only if the work gets done. You also take on a bit less liability if you choose to end the relationship, as compared to firing an employee. These relationships also tend to come with less paperwork and less complicated tax withholding procedures.

The U.S. Department of Labor offers useful summaries of the many laws and agencies governing employment classification. In addition, laws vary from state to state and even among municipalities, but if you’re able to answer “yes” to the following questions in reference to your freelancer(s), then you’re probably in compliance:

- Do they work for more than one client?

- Do they control their hours?

- Do they work off-site?

- Are they working on a defined project with a deadline?

As with any job, when you’re looking to hire a ‘1099 employee’ you’ll want to craft a well-worded job description, ask relevant interview questions, and check references. The only difference is that you’ll need to emphasize the parameters of the employment relationship during each step of the hiring process, starting with the job description.

The only difference is that you’ll need to emphasize the parameters of the employment relationship during each step of the hiring process, starting with the job description.

State clearly, early, and more than once in your job posting that the role is not permanent and that whoever you hire will not be an official employee. Try to describe the contractor role in more than one way. For example, your ad might include the word “contractor” or “freelance” in the job title. Then, you might include descriptions such as “freelance role” or “contract position” in the first paragraph.

You may also want to include some key soft skills in your job description that good contract workers need to have, such as the ability to work independently. You’ll also want to include popular search terms that gig workers tend to use when looking for their next project, including “freelance,” “contractor,” “flexible,” and “independent.”

Once you begin interviewing contractors, reiterate that the role is not a staff position. Ask them directly:

Ask them directly:

- Are you OK with taking on this assignment in a freelance capacity?

- Are you comfortable working independently or do you prefer to work as part of a team?

- How do you react to suggestions and constructive criticism?

It’s likely that any contractor you engage will have access to some vulnerable aspects of your business. A cleaning service may be on the premises when you are not. Any freelancer working on your computer platforms can pose a cybersecurity risk. A bookkeeper or accountant will have access to details of your financial life.

Before you enter into a business relationship with a contract worker, you’ll want to check their credentials. Ask to talk to some of their other clients, check out their presence and customer reviews on social media, and consider running a background check.

Once Your 1099 Worker Begins Working for YouBefore your consultant or freelancers begins working for you, make sure you determine whether you will be paying them hourly or on a per-project basis. Then, draft a contractor agreement that reflects the nature of the working relationship using words and phrases like “project-basis,” “independent contractor,” and “not an employee.” Describe the work that will be done, deadlines and the payment structure. Clarify equipment use, confidentiality and ownership rights over any intellectual property that results from the project. Finally, make sure to include a termination clause.

Then, draft a contractor agreement that reflects the nature of the working relationship using words and phrases like “project-basis,” “independent contractor,” and “not an employee.” Describe the work that will be done, deadlines and the payment structure. Clarify equipment use, confidentiality and ownership rights over any intellectual property that results from the project. Finally, make sure to include a termination clause.

If you hire 1099 workers directly, rather than through an employment agency, you will need to set up the following IRS paperwork:

- W-9 form

- 1099-NEC form

Assuming you pay your contractor more than $600 in any calendar year, you will need to send a copy of the 1099-NEC to the contractor and the IRS by January 31. If you pay via a third-party service, such as a credit card or PayPal, you may need to provide a 1099-K. If you used a 1099-MISC for contractors in the past, be aware that this form is now used for other purposes.

When Is It Time to Turn Your Contractor Into an Employee?When a function you thought would be peripheral to your core business grows beyond your original plan, it’s probably time to offer your 1099 contractor a permanent position. If the DOL, IRS, or state labor regulators have reason to believe you’re using contractors as permanent employees, you can find yourself liable for multiple penalties.

If the DOL, IRS, or state labor regulators have reason to believe you’re using contractors as permanent employees, you can find yourself liable for multiple penalties.

Let’s revisit our bakery scenario to illustrate: If you now own three bake shops, and as a result your contract bookkeeper is billing you for 40 hours a week, and you just found out you’re her only client, then say goodbye to that 1099 and print out a fresh W2. It’s time to offer your contractor permanent employment.

Learn How to Hire a ‘1099 Employee’ to Tackle Your ProjectsIf you have projects eating up your time and distracting from your core business functions, you’ll want to start looking for high-caliber contract workers to take some of that work off your plate. Here at Monster we’re ready to help. Find out how to start checking those distracting boxes off your to-do list by posting your next job with us for free.

The Comprehensive Guide to Hire a 1099 Employee

Independent contractors are a great way for businesses to hire specialists for short-term projects. But hiring contractors can mean jumping through a few hoops for payroll and taxation.

But hiring contractors can mean jumping through a few hoops for payroll and taxation.

In this blog, we’ll take you through the differences between W2 and 1099 employees, guidelines for onboarding 1099 employees, and much more.

Watch this video on YouTube

1 Who is a 1099 Employee?

2 Who is a W2 Employee?

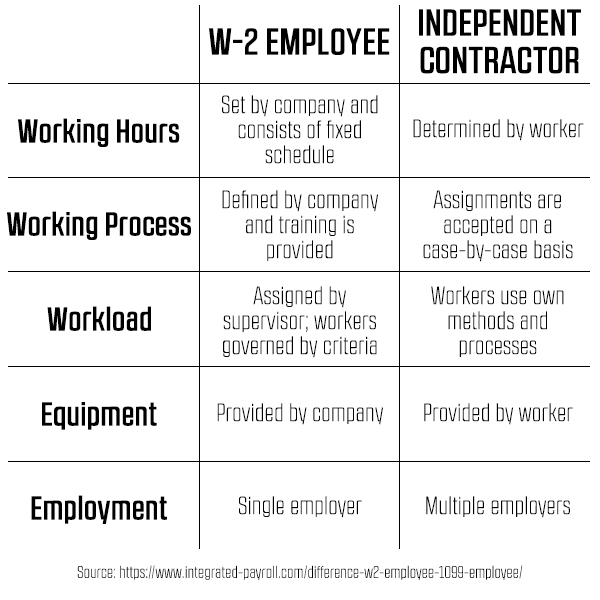

3 1099 vs. W-2 Employee

3.1 The First Category: Behavioral

3.2 The Second Category: Financial

3.3 The Third Category: Types of Relationship

4 Difference between W2 and 1099 Employees

4.1 Tax Forms

4.2 Schedule

4.3 Employment Type

4.4 Training

4.5 Expenses

5 Benefits of a 1099 Employee

5.1 Expertise in Specific Field

5.2 Flexibility

5.3 Easy Administration

5.4 Cost-Effective

5.5 Less Legal Exposure

6 How to Hire a 1099 Employee

6. 1 Ensure a 1099 Employee is Classified Correctly

1 Ensure a 1099 Employee is Classified Correctly

6.2 W-9 Form

6.3 Confidentiality Agreement

6.4 The Correct 1099 Employee Form

6.4.1 1099-MISC

6.4.2 1099-INT

6.4.3 1099-NEC form

6.5 1099 Form Deadlines

6.5.1 January 31

6.5.2 February 28

7 1099 Employee Rights

7.1 Taxes Paid

7.2 Tax Administration

7.3 Work in Several Companies

7.4 Freedom

7.5 Termination

8 Is Hiring a 1099 Employee Beneficial for a Business?

Who is a 1099 Employee?Individuals who are self-employed workers and do not fall under any employment classification rules are known as 1099 employees. The pay to 1099 employees is based on their contract, and the 1099 form is provided to report their income on tax returns.

1099 employees are also considered freelancers, self-employed individuals, and independent contractors. They own their businesses, and they provide a broad range of services to clients. 1099 employees or freelancers establish business relationships with various clients. The clients can range from small businesses to enterprise clients.

They own their businesses, and they provide a broad range of services to clients. 1099 employees or freelancers establish business relationships with various clients. The clients can range from small businesses to enterprise clients.

The reason why this classification is so important is that 1099 employees get paid for the work that they perform for their clients without any tax deduction.

Clients associated with 1099 employees have a lower degree of control as compared to the 1099 employees who have a lot of autonomy over their way of working. Companies can avoid paying taxes by hiring independent contractors or 1099 workers.

A broad range of workers come under the category of 1099 employees, including even blue collar workers, like plumbers writers, and electricians.

Who is a W2 Employee?A W2 employee is a regular employee who works directly for the business and is part of the payroll. Traditionally, W2 employees do not own businesses of their own. They are employed by the business for which they get a salary. The employer holds a high degree of control over the business activities and determines the work schedules, benefits, and wages of W2 employees.

They are employed by the business for which they get a salary. The employer holds a high degree of control over the business activities and determines the work schedules, benefits, and wages of W2 employees.

The employer is responsible for W2 employees’ benefits, perks, and salaries. The employers consequently possess a large degree of control over the employees and also withhold income taxes from the employee’s paycheck. W2 employees are also eligible for any wellness initiatives by the business and work in accordance with all the business requirements.

All employees are classified as W2 employees unless there is a compelling reason to classify them as independent contractors or 1099 employees.

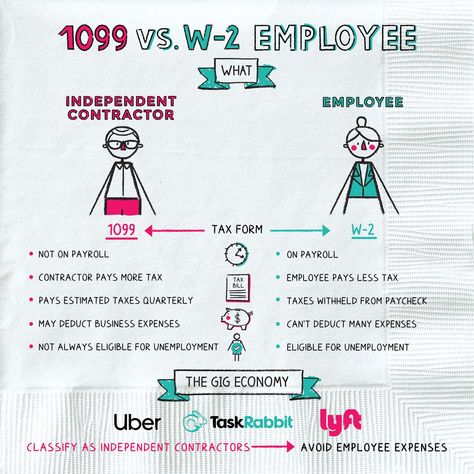

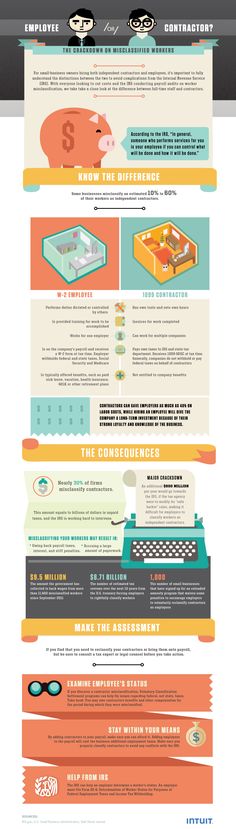

1099 vs. W-2 Employee

Classification of an employee either as a W2 employee or as a 1099 employee is vital for the business. The misclassification of a W2 employee as a 1099 employee can result in penalties from the Internal Revenue Service (IRS). Classification of an employee is also vital for identifying the extent of control that the business has over the pay and schedules of the employees.

However, independent contractors almost always pose a lower cost to the business. This might make unscrupulous businesses misclassify their employees. However, the IRS can audit the business and identify if it has done any misclassification of its employees. It’s certainly more trouble than it’s worth.

Source

IRS provides guidelines clarifying the correct classification of workers into three categories which are listed below-

The First Category: BehavioralThe behavioral category focuses on identifying whether a business can control what, where, how, and when the worker carries out their job.

The Second Category: FinancialThe financial category focuses on determining who controls the economic aspects related to the worker’s job and method of payment.

The Third Category: Types of RelationshipThe types of relationship categories are focused on determining whether the employee receives benefits or not. This along with the documentation filed can establish the type of relationship between an employee and the business.

This along with the documentation filed can establish the type of relationship between an employee and the business.

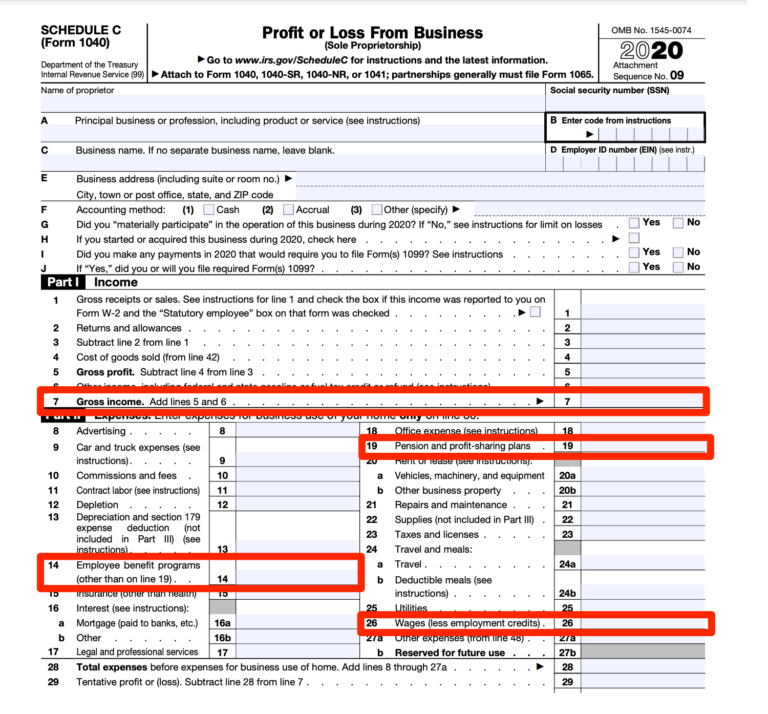

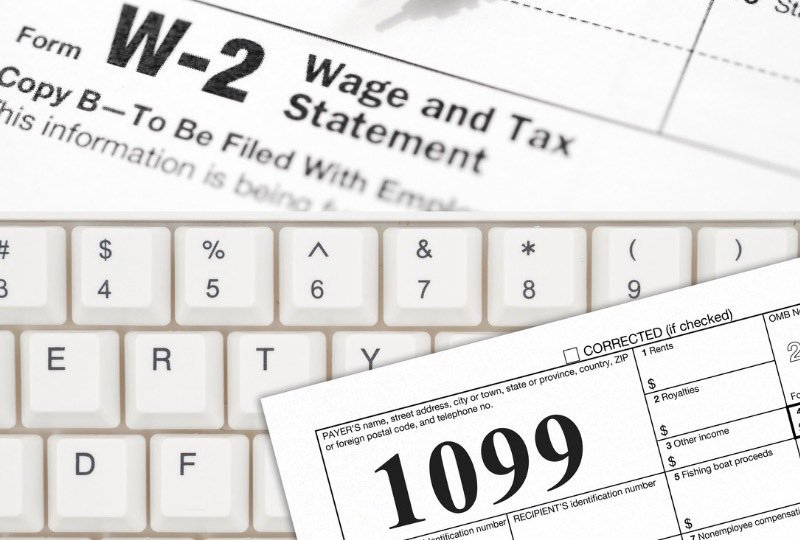

In terms of tax forms, independent contractors and permanent employees on the company payroll have two different tax forms. Unsurprisingly, a 1099 form is filed for 1099 employees and a W2 is filed for W2 employees for payroll taxes.

A 1099 employee is an independent contractor, and businesses pay them according to their contracts. On the contrary, a W2 employee is a salaried employee who receives wages and employee benefits regularly. The business not only holds a large degree of control over the W2 employee’s work but also withholds income taxes from the employee’s paycheck.

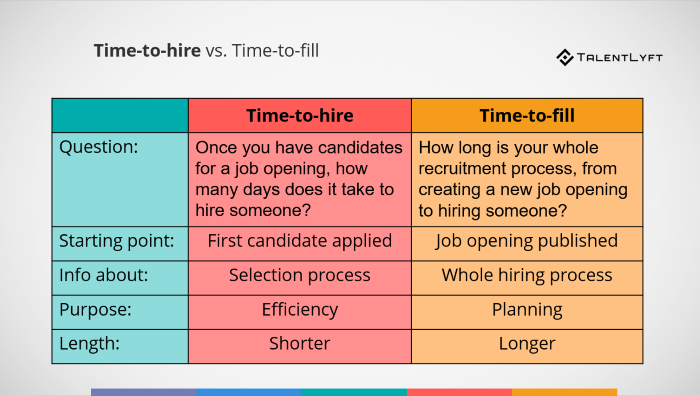

ScheduleA 1099 employee is hired by a business for a specific project or task. 1099 employees provide the business flexibility in terms of hiring and “firing”. Their hours spent with the business are dependant on the project requirements and their own schedules.

On the contrary, W2 employees are controlled by their employers as the employer determines the schedule and remuneration for W2 employees.

Employment TypeA 1099 employee is self-employed, while W2 employees are salaried employees. Unlike 1099 employees, W2 employees do not own a business. Rather, they work for a business and work towards achieving the business’s goals.

A 1099 employee provides only services that are defined in the written contract. It is entirely up to them if they wish to cater to just a single client or many at the same time. There is no non-compete clause associated with their services rendered. But W2 employees can only work full time with one business at a time.

Training1099 employees do not need to be trained by the organizations as are experts and are hired for their expertise. On the contrary, W2 employees need to be trained to adhere to processes and to improve their skillset.

1099 employees mostly perform tasks without the employer’s processes. Their goals are oriented to end-results and process creation. However W2 employees have to follow the businesses’ processes while performing all tasks.

Their goals are oriented to end-results and process creation. However W2 employees have to follow the businesses’ processes while performing all tasks.

Independent contractors or 1099 employees are responsible for their own employment expenses and taxes. While in the case of W2 employees, the business withholds payroll taxes from their salaries to cover the employment expenses.

A 1099 employee is not eligible for unemployment benefits, but the W2 employee is eligible for unemployment benefits in special cases.

Benefits of a 1099 EmployeeExpertise in Specific FieldPerhaps the most significant advantage of working with a 1099 employee is the expertise possessed by the 1099 employee in a specific field. In case a venture requires particular expertise or specialized ability, the business can hire a 1099 employee who has constructed a business around that very specialization. 1099 employees possess specialized skills and expertise that are more streamlined or missing in the capabilities of the organization’s core team.

1099 employees are well versed in their domain and bring additional experience to the organization.

FlexibilityBusinesses and organizations can hire a 1099 employee for as many projects as the budget allows. Contrary to a W2 or a regular employee who is associated with the business for a long period, 1099 employees provide flexibility to the businesses in terms of prioritizing and shifting resources.

Organizations hire 1099 employees for accomplishing a specific project as they can focus on a particular project without increasing the employee headcount.

Easy AdministrationAdministration becomes significantly easy for the organization by employing an independent contractor. The initial paperwork is quite less, and payroll is easier as the employers do not hold any responsibility when it comes to withholding payroll tax. However, an organization needs to make sure that the classification of employees is correct each time.

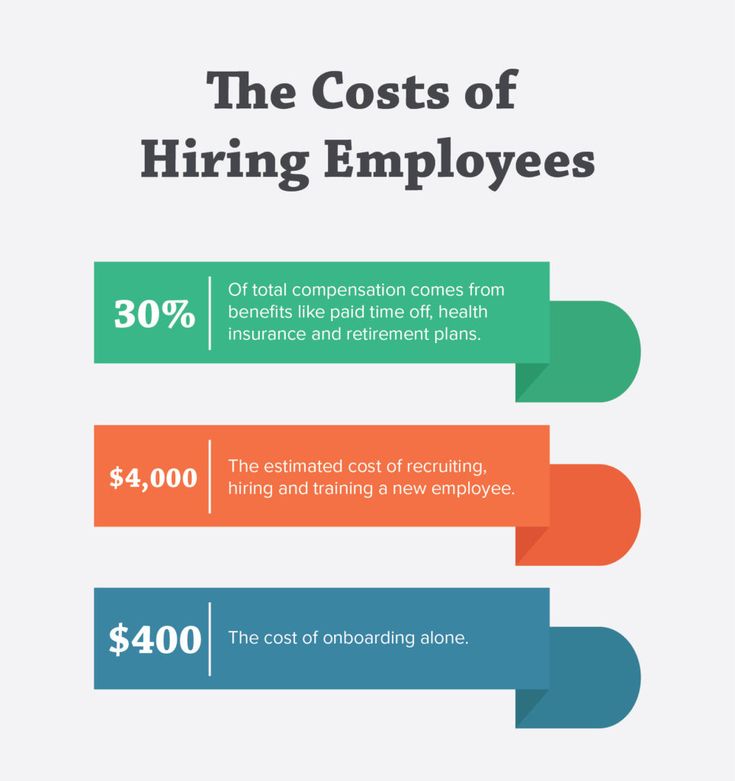

Cost-EffectiveCost-effectiveness is a vital factor for businesses, and it can be achieved by utilizing a 1099 employee in place of a W2 employee. There is no need to provide minimum wage and benefits to 1099 workers or independent contractors.

There is no need to provide minimum wage and benefits to 1099 workers or independent contractors.

Moreover, the paperwork is quite less for an independent contractor or 1099 employee as compared to a W2 employee.

Less Legal Exposure1099 workers are not eligible for any kind of compensation coverage. Additionally, they cannot make wrongful termination claims, which in turn lowers the legal exposure of the business.

How to Hire a 1099 EmployeeHiring reliable 1099 workers or freelancers can be beneficial for organizations. They can provide certain benefits, including cost-effectiveness, flexibility, less paperwork, and extensive expertise in a particular domain. Companies need to be careful while hiring independent contractors to benefit from the onboarding of independent contractors.

After signing the employment contract that should ideally include expectations, termination terms, duration of the project and equipment provided, the next steps are:

Ensure a 1099 Employee is Classified Correctly

Make sure that a 1099 employee is:

- Not working full time for the business

- Does not require any special training and supervision

- Offered any benefits

- Clear about their employment status with the company

A W-9 form is a must for all independent contractors. A W9 provides their:

A W9 provides their:

- Name

- Current Address

- Tax Identification Number

- Eligibility to work in the United States

It doesn’t need to be sent in anywhere but every business must have the W9s of all 1099 employees on file. Getting all details, in the beginning, will save you many headaches later.

Confidentiality AgreementA non-disclosure agreement (NDA) is integral for independent contractors. This confidentiality agreement should outline that any confidential material, information, and knowledge cannot be shared with a third party.

Not all businesses require an NDA but to cover all bases it is prudent to get one signed during onboarding of the contractor.

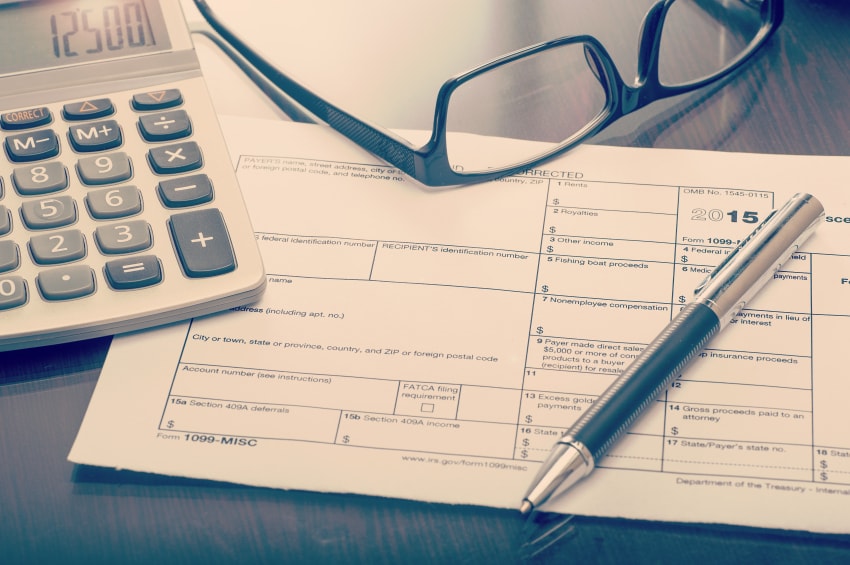

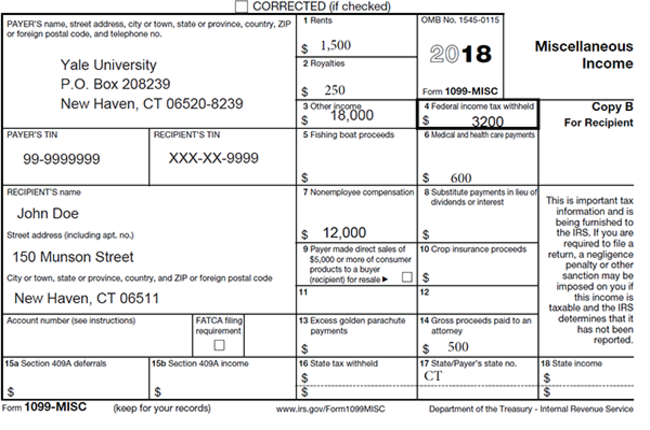

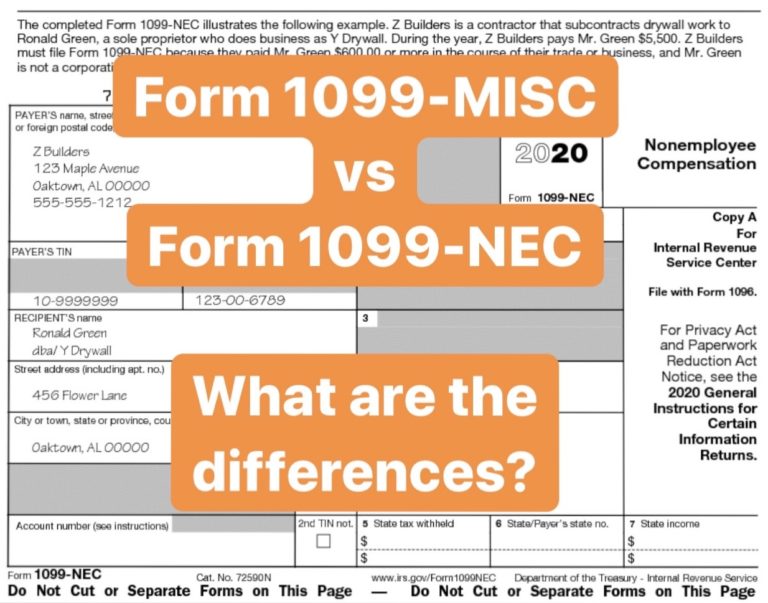

The Correct 1099 Employee FormA 1099 employee form is a document or a combination of documents that are used by the IRS for tracking various types of income, excluding the salary that an employer receives. The person who pays is responsible for providing a 1099 employee form to the independent contractor. There are various kinds of 1099 employee forms, including the 1099-MISC form and 1099-INT form.

There are various kinds of 1099 employee forms, including the 1099-MISC form and 1099-INT form.

1099-MISC is a document for people who engage an independent contractor or freelancer and pay them an amount above $600 annually. Employers need to submit the 1099-MISC form for individual independent contractors who receive an income over $600.

1099-INTThe 1099-INT form is a document that is received from banks where the independent contractor holds interest-bearing accounts. The interest that is earned on investments is taxable, and in this aspect, it is reported to the IRS.

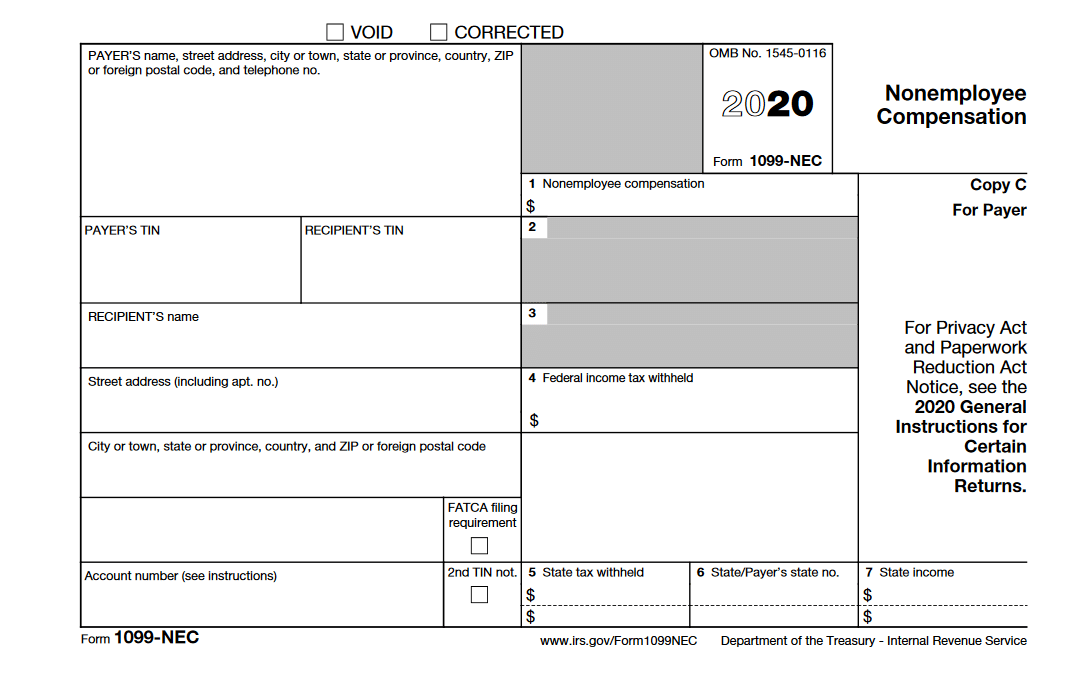

1099-NEC formA 1099-NEC form reports non-employee compensation. The 1099-NEC form is not a replacement for the 1099-MISC form but rather replaces its usage for reporting independent contractor payments. The 1099-NEC reports how much an independent contractor earned while working with the client. This does not include payments made via credit cards or third-party settlement platforms.

The independent contractor, as well as the employer, needs the 1099-NEC form for filling out the taxes. The 1099-NEC form has two copies, Copy A is filed with the IRS, and Copy B is sent to the individual contractor by the employer. The 1099-NEC form is not part of the State Filing Program, which is why an employer might need to submit 1099-NEC to the state where the independent contractor works. 1099 employee taxes can be determined by filling and submitting the form.

1099 Form Deadlines

January 31

1099 forms must be sent to all your 1099 employees by the end of January. If this day falls on a weekend, the deadline is extended till Monday.

February 28

1099 forms issued must be filled and sent to the IRS by the end of January. Not filing these forms accurately and on time can open the business to penalties.

Source

1099 Employee RightsTaxes PaidThe 1099 employees do not pay social security and unemployment taxes. Instead, they pay taxes on the gross pay received from organizations. Subsequently, businesses can be on the hook for backdated taxes if they fail to classify independent contractors correctly.

Instead, they pay taxes on the gross pay received from organizations. Subsequently, businesses can be on the hook for backdated taxes if they fail to classify independent contractors correctly.

If the IRS identifies that a salaried employee has been represented as an independent contractor there will be repercussions. The business can be held accountable for backdated withholdings to the tax administration.

Work in Several Companies1099 employees do not possess an exclusive employment relationship with any organization. However, this makes them ineligible for benefits like minimum wages, overtime payment, and other perks.

However, the business cannot prevent 1099 employees from working with several companies simultaneously either.

FreedomIndependent contractors possess the freedom to work from their place and at their convenience.

However, a situation may arise where the client expects the 1099 employees on-site during a specific project. In that case, the employer is responsible for providing the necessary tools and equipment to the independent contractor.

In that case, the employer is responsible for providing the necessary tools and equipment to the independent contractor.

The business can end the agreement of the 1099 employee at will in case explicit termination conditions are not included in the contract. It is the right of the individual contractor to discuss the termination procedure before agreeing to work on a project and incorporate it into the contract.

Is Hiring a 1099 Employee Beneficial for a Business?

A 1099 employee can bring benefits such as cost-effectiveness and flexibility. However, the business needs to determine and define the requirements of an independent contractor.

Are you finding it hard to track hours for your 1099 employees? We think AttendanceBot, a time tracking solution that functions right within MS Teams and Slack, can help.

Steps to Hiring an Employee 1099 (plus what forms are required) • BUOM

Posted by the Indeed Editorial Team

April 12, 2021

Companies often hire 1099 employees because they can help quickly complete non-essential tasks and facilitate growth and development business. If you are looking to work with independent contractors, it can be helpful to understand their key benefits and the most effective way to hire them. In this article, we will discuss what is Employee 1099 why companies hire him and give you a list of steps on how to hire him yourself and what documents you will need.

If you are looking to work with independent contractors, it can be helpful to understand their key benefits and the most effective way to hire them. In this article, we will discuss what is Employee 1099 why companies hire him and give you a list of steps on how to hire him yourself and what documents you will need.

What is employee 1099?

A 1099 employee is an individual who offers his services to companies and organizations as a freelancer. The term "1099" refers to certain forms that an individual must complete in order to classify their work and current position in the company as an independent contractor. When hiring an employee 1099 Companies often negotiate a contract that sets out the terms of the project and payment for the assignment. Freelancers work until they fulfill their contract, at which point the company decides whether to renew or terminate their services.

Why hire employee 1099?

Here are a few reasons why hiring a 1099 employee can be beneficial to a business or organization:

Financial savings

Hiring independent contractors can help companies and organizations save money in several business areas, including office space and equipment, insurance and benefit packages and additional training and development. Because of this, companies often only pay freelancers for their direct services and often don't charge extra to help them fulfill their responsibilities.

Because of this, companies often only pay freelancers for their direct services and often don't charge extra to help them fulfill their responsibilities.

Easy maintenance

Businesses that hire freelancers may find it easier to onboard and pay. This is often because independent contracts require fewer paperwork and background checks. Payroll is also easier to maintain because it requires no withholding taxes and only happens at pre-determined times specified in the contract.

Flexibility

When companies hire people on a contract basis, they have the ability to hire people who specialize in particular areas or practices. This may allow businesses to contract professionally trained employees who can help in special circumstances. For example, if a company needs a graphic designer to create new marketing promotions, they may hire a professional to help them out until the job is done.

How to Hire a 1099

Here is a list of steps you can follow to help you hire a 1099 employee:

help them correctly report employment relationships to the Internal Revenue Service (IRS).

Defining the working relationship accurately can help businesses protect their assets and avoid any legal complications down the road. When classifying a person's status in a company, the IRS often uses a system to help them that uses three different factors:

Defining the working relationship accurately can help businesses protect their assets and avoid any legal complications down the road. When classifying a person's status in a company, the IRS often uses a system to help them that uses three different factors: Behavioral control

Behavioral control helps to determine how much the company controls the work of employees and how they perform it. This may include determining whether the company provides additional training, whether they allow the employee to choose their own schedule, and whether the employee can choose the order in which they perform their work.

Financial control

Financial control determines how the company manages payments and finances. This may include whether the company pays employees' expenses, whether the employee issues invoices for payment, and whether they provide their own tools and equipment for the job.

Relationship factors

Relationship factors determine whether a contract has been entered into and what specific benefits or information it includes. For example, if a company provides vacation and health insurance, the IRS may classify the person as a full-time or part-time worker rather than a freelancer.

For example, if a company provides vacation and health insurance, the IRS may classify the person as a full-time or part-time worker rather than a freelancer.

2. Check an employee's credentials and work history

Checking an employee's credentials and work history can be helpful for companies to understand how well that person can contribute to their project or goal. This can help businesses make sure the freelancer has the right education and training for the job, and can help compare the asking price to their professional experience.

For some positions, the government may also require background checks, especially if the independent contractor works with the elderly, children, or people with disabilities.

3. Create a contract

Creating a detailed contract for freelancers can help companies classify them for the IRS and establish project or assignment guidelines that independent contractors can easily follow. It can be helpful to include details of payment plans, duration of work, and any necessary non-disclosure agreements in the contract.

If the freelancer is designing and developing creative work, it may also be important to clarify who owns the intellectual property rights.

4. Have them fill out the appropriate forms

When they formally want to hire an independent contractor for a company or business, it may be important for them to fill out the required paperwork before they begin, as well as keep track of any forms that need to be completed after they complete own responsibilities. These forms may include:

Written contract

Before a freelancer starts work, it may be important for the company to fully discuss the contract and get a personalized indication that they understand and agree with the terms and conditions of the project. Once a contract has been signed, it may be beneficial for a company to keep a copy of the document for its records.

Form W-9

W-9 is the tax form that the IRS requires from independent contractors. The form asks for the contractor's name and tax identification number, and whether the freelancer is eligible to work in the United States. It may be important for companies and businesses to have a copy of Form W-9each independent contractor on file.

It may be important for companies and businesses to have a copy of Form W-9each independent contractor on file.

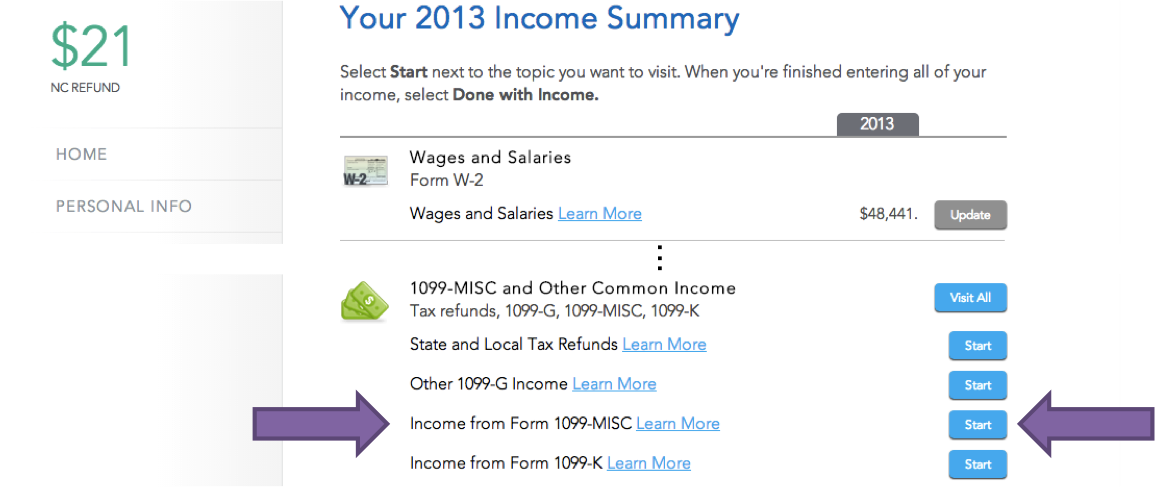

1099-MISC

A 1099-MISC is usually required if a company or organization paid a freelancer more than $600 for their services in one year. If so, the company must send a form to their freelancer by the end of January detailing how much the person received during the year.

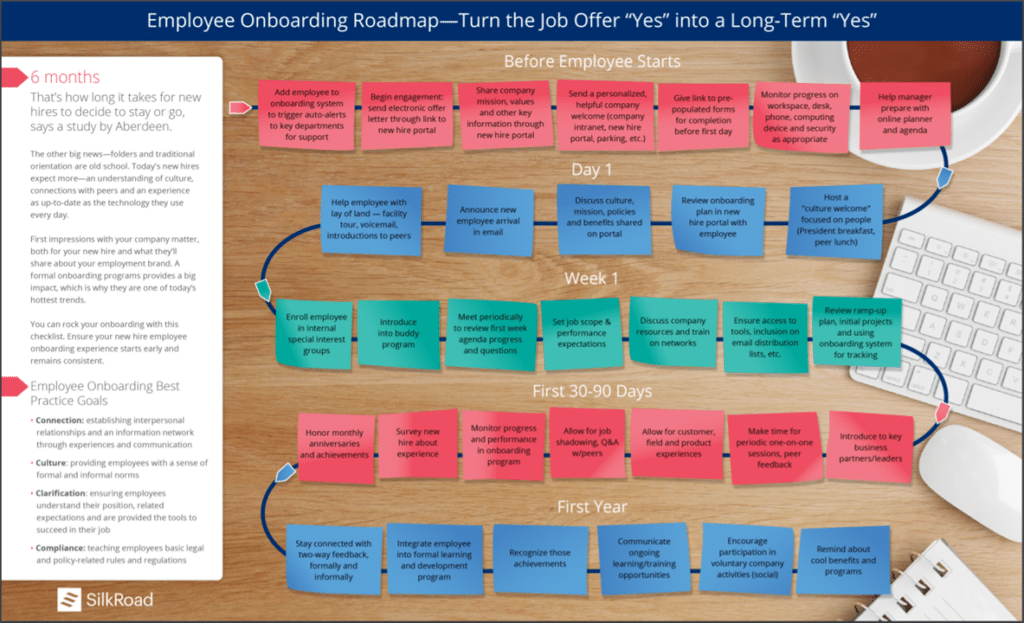

5. Integrate into the company

Integrating freelancers into the company culture can help them perform their duties more effectively and increase job satisfaction. When you hire an independent contractor, it can be helpful to have an initial meeting in person or virtually, welcoming them to the company and conveying important information, such as the mission and purpose of the company, with the assignment completed.

It may also be helpful to introduce them to other employees and provide them with a list of people they can contact with specific questions or concerns about their project. This can help them feel involved in the development of the company and contribute to the development of the company, as well as allow them to fulfill their contract more effectively.

This can help them feel involved in the development of the company and contribute to the development of the company, as well as allow them to fulfill their contract more effectively.

everything you need to know

Employee 1099 is not really an employee of the business. It sounds contradictory, right? Relax! The term "employee" is often used to describe someone who is paid to do a job. However, not everyone who receives payment after services are rendered is an employee. Some of them are independent contractors, consultants or even freelancers. Each employer is required to report the amount paid to each non-employee to the IRS using Form 1099 NEC, and thus the term "1099 worker" was born. Every independent contractor or freelancer must file a Form 1099 tax return in the tax year. The employer also reports the payments of its employees using Form W-2. There are distinct differences between W-2 and 1099 employee uniforms, and we will highlight this, as well as the benefits that independent contractors enjoy.

What is employee 1099?

A 1099 employee is anyone who provides services to a business but is not an employee of that business, but rather has a contract to provide their services. Although 1099 employees may seem strange, this is something you are familiar with. I mean, you often hear about the freelancer or independent contractor, right?

Employee 1099 does not receive benefits or tax deductions from the employer. He only receives their base fee for his services and nothing more. They are not workers, so they are called by different names: contractors, freelancers, self-employed and business owners. Depending on their path to becoming independent contractors, they may be self-employed.

Features 1099 Employee

Below are the characteristics of 1099 employees;

- DOL independent contractors have fewer guarantees regarding discrimination, minimum pay and maximum hours.

- They do not have regular employee benefits such as an office, paid vacation, overtime pay, or workers' compensation, but they can choose when and where to spend their time.

- Clients 1099 workers say almost nothing about how workers perform their duties.

- DOL independent contractors have fewer guarantees regarding discrimination, minimum pay and maximum working hours.

If they are just employees, why call them 1099 employees?

The term "employee 1099" comes from Form 1099-NEC or 1099-MISC, which corporations use to report payments made to contractors.

What are the examples of 1099 employees?

When it comes to 1099 employees, this is unique in every industry. It simply means that they exist according to the needs of the business. Anyway, below are some of the most common 1099 employees you see often;

#1. Consultants

Expert consultants, such as lobbying consultants, are hired at great expense to provide strategic guidance.

#2. freelance artist

Freelancer is 1099 employees who are hired for a limited period. The main task of a freelancer is to meet the needs of the business with their skills. They take on different jobs at the same time because their clients approach them individually. Sometimes they get paid at the end of a project or after reaching an agreement with their clients. You will find them in several fields such as marketing, finance, design, technology development and so on.

They take on different jobs at the same time because their clients approach them individually. Sometimes they get paid at the end of a project or after reaching an agreement with their clients. You will find them in several fields such as marketing, finance, design, technology development and so on.

#3. Outsourcing workers

Outsourcing is somewhat related to freelancing. However, the business forces a third party to temporarily work for them. Contract workers may sometimes be considered temporary or temporary employees.

No. 4. Gig worker

Gigworker is a 1099 employee who works independently as a contractor. They usually take on short-term assignments through a mobile app or virtual job market.

Are there rules governing the recruitment of 1099 employees?

Employers should be aware of the rules for 1099 employees before entering into an agreement with any 1099 employee. Below are some considerations for employers with 1099 employees;

#1.

1099 employees must handle their own tasks

1099 employees must handle their own tasks This simply means that anyone who will be paid as a 1099 employee must provide their own tools and work from their own offices. They can also work at their convenience.

No. 2. Correctly classify 1099 employees

Workers who are paid 1099 must be accurately classified. There are legal criteria that must be met before classifying any worker as a 1099 employee. Speaking of legal requirements, each state has specific rules regarding this, so it's best to find out what's right for you depending on your location in the United States.

#3. Written agreement

Employers must provide an agreement with employee 1099, even if the employee is not a W-2 employee. The contractual agreement will entail the obligations and conditions of the parties involved.

No. 4. Employers require an IRS Form W-9 for their independent contractors.

Just in case you're wondering why employers need an IRS Form W-9, it's because they must provide Forms 1099-NEC or 1099-MISC to their 1099 employees as well as to the Internal Revenue Service. Therefore, the form is used to verify information provided about independent contractors when it comes to income tax.

Therefore, the form is used to verify information provided about independent contractors when it comes to income tax.

No. 5. 1099 employees pay their own taxes

Employers must report only the amount paid to 1099 employees using the 1099 NC form and nothing else. They don't have to withhold the contractor's salary at any time. This is because these guys are directly responsible for their income taxes in the first place.

No. 6. 1099 employees have their own insurance

Employees who are paid under the 1099 system are expected to have their own company insurance, such as liability insurance. Workers who are classified as 1099 are not eligible for health insurance benefits through their company. Also, the company will not be liable for employee 1099.

No. 7. Employee 1099 is not eligible for employment benefits

People who are paid based on 1099 do not receive the same protections and benefits as those who work for more traditional scheme. This is a feature as well as a rule. Well, you can already understand what that means, and you're right. This means that there is no such thing as overtime allowances, not even the minimum wage applies to them.

This is a feature as well as a rule. Well, you can already understand what that means, and you're right. This means that there is no such thing as overtime allowances, not even the minimum wage applies to them.

No. 8. 1099 Must be paid in full

Paying independent contractors quickly and easily is a major need for many companies. Therefore, they often use the 1099 payroll platform. However, since a contract worker must report their earnings to the IRS, employers should avoid using peer-to-peer payment methods. This is mainly done in order to avoid tax evasion.

No. 9. Agreement can be terminated at any time

This applies when both parties are happy with each other. As soon as they come to an agreement, the contract can be terminated.

Are there any advantages in hiring a 1099 employee?

Of course, outsourcing employees within the firm has a number of advantages. Following are some of the benefits of hiring a 1099 employee;

#1.

No induction training

No induction training You don't have to pay for onboarding training for 1099 employees because you've already invested in their own education and growth. You do not supply their tools and equipment

No. 2. It's cost effective

If you hire a contractor, you won't have to worry about covering their health insurance or instrument licensing costs, which will reduce your overall employer costs. Neither the contractor nor you need to supply any tools (laptops, monitors, etc.

#. Contract termination without enforcement

Contractors are conveniently hired for one-time jobs or sudden bursts of work, and then fired when their services are no longer available necessary

Can you explain why it is preferable to work as contractor 1099?

Working as a 1099 employee has its advantages, and here are some of them:

- The chances of earning more.

- They have a lot of leeway in deciding when to work and for how long.

- Because of this adaptability, they have more say in their work-life balance.

- The freedom to choose your ideal working conditions.

Do 1,099 employees pay taxes?

Generally, everyone who earns income in the United States pays taxes. So yes, worker 1099 pays taxes too. Independent contractors or freelancers in the United States are required to process their own tax returns. They actually pay a self-employment tax that covers their Social Security and other taxes.

How do you classify an employee as employee 1099?

The Internal Revenue Service offers a test that identifies the three most important factors in deciding how to classify a worker.

#1. Business Relationships

As part of a business relationship, the IRS seeks to know the type of relationship between an employee and an employee. Is there a formal agreement between the company and the employee? How long do they work for you? Do employees receive insurance and other benefits? The answer to the above question helps in classifying the worker.

No. 2 Work Practices/Behavioral Factor)

In terms of behavioral factors, the IRS seeks to know if the business dictates an employee's tasks and methods. If the company is interested in the result, and not in how the work is done, then it is classified as 1099 employees. You're more likely to work with an independent contractor if the person you hire decides how, when, and where to get the job done.

#3. Degree of Control/Financial Factor

The IRS is looking for answers to the following questions here; Do you have a final word on when they can take the day off, how much they will be paid, and whether they will be reimbursed for business expenses? Who decides things like equipment and tools? According to the IRS, whenever an employer makes the above decision, they are no longer an employee of 1099.

Do you need documents to conclude a contract with employee 1099?

Of course, remember the rules, it is very important to have a binding agreement. You need your contract to come with an agreement, even if they are not full staff.

You need your contract to come with an agreement, even if they are not full staff.

What documents do you need to hire a 1099 employee?

Below are the main documents required to conclude a contract with employee 1099;

#1. Written agreement

There must be a written agreement containing all terms, fees, and penalties. The contract protects the interests of all. Any business relationship between an independent contractor and its client must be in writing.

As a general rule, having a written record of the terms of the agreement makes it easier to manage the partnership and, if necessary, terminate it.

No. 2. Tax forms

Independent contractors who want their clients to pay them accurately must include the appropriate company information on their tax form.

Employee Form 1099

Employee Form 1099 is a record that documents the amount that an employer paid a non-employee for his or her services. The payer completes the form and submits it to the IRS and the independent contractor. It is important to note that there are numerous variants of Form 1099. I think about 20 at the time of this writing. Typically, the last day to send forms to 1099 recipients is January 31st.

It is important to note that there are numerous variants of Form 1099. I think about 20 at the time of this writing. Typically, the last day to send forms to 1099 recipients is January 31st.

Who uses Form 1099 Employee?

Employers use Form 1099-MISC, Miscellaneous Information, or Form 1099-NEC, Non-Working Compensation, to report the payment to each freelance worker.

What do employers do with the 1099 employee form?

In accordance with IRS guidance, employers use Form 1099 for employees to do the following;

- Report any payments of $600 or more made to anyone other than an employee in the course of a trade or business.

- Report any payment of $10 or more that was made during the exchange gross fee or a payment of $600 made in the course of a transaction.

- Payee

W-2 vs. 1099 employees

You will most likely see forms W-2 and 1099for employees with an employer and not with another person who uses it to report income tax for the tax year. Long before we dive into the W2 vs. 1099 employees form, let's take a look at what each of them is.

Long before we dive into the W2 vs. 1099 employees form, let's take a look at what each of them is.

What is a W-2 employee?

A W-2 worker is someone who receives a salary or hourly wage from a company on a regular basis and is therefore paid directly through the company's payroll system. Hiring costs tend to be higher due to the following factors: W-2 employees may be eligible for benefits and training programs, and the company is responsible for withholding taxes and paying public insurance. Companies get more flexibility in when, where and how employees do their jobs. And these employees must strictly adhere to the policies and rules of the company. In addition, a W-2 employee may work part-time or full-time.

What is the difference between employee 1099 and W-2?

This concept may seem a bit contradictory, but it's really simple once you understand it. The staff of the company is known as a W-2 employee, while the contracted or outsourced worker is known as a 1099 employee. The main similarity between the two is that the company pays them and therefore must report their earnings. However, the employer will report staff income on Form W-2 and 199 employees on Form 1099. In addition, there are other notable differences, including the following:

The main similarity between the two is that the company pays them and therefore must report their earnings. However, the employer will report staff income on Form W-2 and 199 employees on Form 1099. In addition, there are other notable differences, including the following:

#1. Employee W-2 VS 1099: Training and Onboarding

The first thing we will point out on the W-2 against 1099 employees is company training and onboarding. Typically, employees or W-2 employees go through an "onboarding" process and training when they are hired by the company. However, an independent worker is hired because the employer believes that he already has the necessary skills and experience.

No. 2. W-2 VS 1099 Employee: tools and equipment

Companies provide their employees with certain tools and equipment to make their job easier, but the independent contractor provides their own work tools.

#3. Employee W-2 vs. 1099: Work Schedule

Speaking of W-2 and 1099 forms for employees, one notable difference that needs to be identified is the work schedule. The employee's 1099 form specifies their hours of work, but the W-2 employee must follow the employer's rules. Independent contractors are not subject to hours set by their clients, but employees are.

The employee's 1099 form specifies their hours of work, but the W-2 employee must follow the employer's rules. Independent contractors are not subject to hours set by their clients, but employees are.

No. 4. W-2 VS 1099 Employee: Employee Benefits

Another great thing to note when discussing the W-2 vs. 1099 employee form is the benefits available to each party. The W-2 worker will receive certain statutory benefits, but the independent worker will not. State laws determine which employees are eligible for benefits such as Social Security, Medicare, health insurance, unemployment insurance, and paid leave, while they do not apply to an employee 1099.

Is it worth it to be a 1099 employee?

Of course, being a 1099 employee brings many benefits that are worth it. You are in charge of your working hours and can get jobs from different people, which increases your income.

What are the disadvantages of working in the 1099 program?

There are shortcomings in working as 1099 employees, this includes full responsibility for paying all of your own Medicare and Social Security taxes, health insurance, retirement savings, and professional tools and equipment.

Who pays taxes for employee 1099?

Employee 10999 pays the tax himself. In fact, the employer does not remove anything from his salary.

Do 1099 employees pay more taxes?

To measure. Self-employment may come with higher tax payments, but there's also the benefit of business deductions if you take advantage of it.

How long can you be a 1099 employee?

It depends on the length of your contract. 1099 employees is only a contract and you work as long as your contract is open.

Conclusion

The 1099 employee is truly no stranger to anyone who works as an independent contractor. Because they receive different forms of this form every year. However, it is also important that they understand how to maximize the business owner's tax credits in order to avoid spending too much.

1099 frequently asked questions of employees

Can I write off meals as an employee 1099?

Depending on the specifics, a freelancer may be entitled to deduct part of their food expenses as business expenses.